Strength of economy and demographic trends key drivers

EDANA, the international association serving the nonwovens and related industries has 247 member companies in 35 countries. Every year the association organises a number of international conferences and is the sponsor of INDEXTM, the world's leading nonwovens exhibition. Pierre Wiertz, general manager, EDANA discusses at length the market for nonwovens globally.

Nonwoven filter media account for around 6 per cent of nonwovens consumption globally. Growing focus on air pollution control, indoor air quality, energy saving in heating, ventilation and air conditioning as well as vehicle engine and turbine filtration will drive faster than average growth rates for this kind of nonwovens, and similarly as far as needs for water and other liquid filtration are concerned.

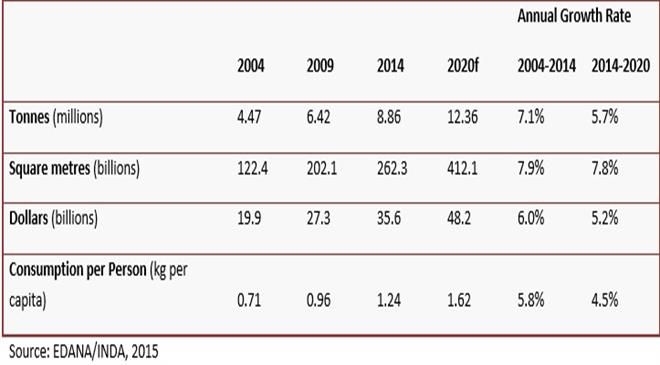

The worldwide production of nonwoven roll goods reached 8.9 million tonnes in 2014, equivalent to $35.6 billion. The tonnage volume was equal to about 262 billion sq m in 2014. EDANA and INDA forecast worldwide nonwovens production will continue to grow, and expect that in the period from 2014 through 2020 the industry will expand at an annual average rate of 5.7 per cent and reach a volume of at least 12.4 million tonnes.

Table 1: Outlook for Worldwide Nonwovens Production

Asia is now the dominant nonwoven producing region, accounting for 42 per cent of the world's production in 2014, up from 32 per cent in 2004. China accounts for a significant proportion (66 per cent) of the Asia volume and is now the most important nonwovens producer worldwide with production volume in 2014 estimated at 2.4 million tonnes and equivalent to more than a quarter (27 per cent) of global nonwovens production in 2014. The production of nonwovens in North America is expected to improve, resulting in tonnage production increasing 5.3 per cent annually by 2020. As a result, nonwovens production in North America (2.1 million tonnes in 2014) is expected to catch up with that of Greater Europe (2.2 in 2014), which will experience a lower nonwoven growth of around 4.8 per cent until 2020. Both are expected to reach about 2.9 million tonnes in 2020. (Source: EDANA-INDA Worldwide Outlook for the Nonwovens Industry 2014-2020)

Since INDEXTM17 caters to the needs of all sectors-from personal care, healthcare and household applications, to automotive, filtration and high-tech electronics-it would not be fair to isolate or highlight any particular one, but there will be many innovations from all those sectors.

South American nonwovens output, after experiencing 4.7 per cent annual growth over the last decade, will grow at a faster pace-6.6 per cent annually-during the forecast period. In Middle Eastern & North African (MENA) countries, by 2020, the nonwovens output will keep growing by 7.1 per cent annually. India, Indonesia and Iran, starting from lower levels, will also experience moderate to high growth rates.

The strength of the economy and demographic trends are the significant drivers of demand within the nonwovens industry. Consumer discretionary spending and business investment-both correlated to the strength of the economy-drive demand in nearly every nonwoven end use category, while certain demographic trends-such as births and aging-drive demand in the remaining end use categories. The basic building blocks of nonwovens' demand are thus based upon the global economic and population forecasts. Growing purchasing power allows people to buy nonwoven-based products to fulfil their-until then- unmet needs in personal care, healthcare, etc. With their population's disposable income on the rise, many Asian countries lead the way in these favourable trends for nonwovens, thereby demonstrating our industry's products' tremendous improvement of people's lives. This also applies to the Latin American and African markets.

As far as nonwovens is concerned, this is nothing new: recycled polyester has been used in nonwovens for many years now, and based on information collected from its members, EDANA statistics reveal that 40 per cent of the polyester consumed in the production of spunbond is already recycled polyester. On the other hand, EDANA nonwovens statistics also show that 30 per cent of the polyester staple fibres consumed in Europe to produce nonwovens are now recycled fibres from bottle-flakes, too.

EDANA and its member companies have been active in the field of life cycle assessment (LCA) for more than 25 years This dedication to measuring environmental performance and actively using LCA for product development continues to the present day, with the obvious objective of making every possible effort to reduce the overall environmental footprint of nonwovens, in all dimensions. As far as the cradle-to-grave environmental impact of the manufacture of nonwoven roll goods is concerned, the feedstocks (depending on the polymers used, though) and the process energy required are generally the main contributors to the environmental impact of nonwovens.

Both in view of and beyond INDEXTM17, EDANA remains focused on its vision to "provide global leadership to create an environment beneficial to sustainable and profitable growth of the nonwovens and engineered fabrics and related industries to best serve our customers." In line with this vision, we will reinforce our ongoing efforts to ensure an optimal image and perception of our industry by all important stakeholders.

DISCLAIMER: All views and opinions expressed in this column are solely of the interviewee, and they do not reflect in any way the opinion of technicaltextile.net.