By combining the complementary offering and competences of Valmet and the acquired business, Valmet creates the markets’ widest technology, automation and services offering for the growing tissue industry covering the entire tissue value chain. Growth in tissue demand is driven by several favourable trends such as increased hygiene awareness and standards of living.

Korber’s Business Area Tissue offers process technologies and related services for converting the jumbo reels of tissue paper into final tissue products for consumers and the Away from Home segment. It has the broadest offering in the tissue converting industry with converting lines for tissue rolls and for folded tissue including product packaging, as well as services and digital solutions.

In 2022, Korber’s Business Area Tissue’s net sales amounted to €305 million and its adjusted EBITDA margin was approximately 12 per cent. The company has a strong and growing services business, which accounted for 36 per cent of total net sales in 2022. The business employs around 1,170

The enterprise value of the acquisition is approximately €380 million on a cash and debt free basis subject to ordinary post-closing adjustments. The acquisition is estimated to be completed at the earliest on November 2, 2023, subject to competition authority approvals. The transaction consideration will be paid in cash upon the completion. Valmet will finance the acquisition with debt. The financing package for the acquisition consists of two facilities underwritten and committed by Danske Bank A/S and Nordea Bank Abp, a €250 million term loan facility maturing in January 2028 and a €150 million term loan facility maturing in two years from the closing of the acquisition.

Valmet estimates that the acquisition will bring sales, service and cost synergies worth €8 million by the end of 2026. The acquired business will be integrated into Valmet’s paper business line as a separate business unit. In Valmet’s reporting, the process technology part of the business will be consolidated to the paper business line and the services part to the services business line.

At the end of first quarter of 2023, Valmet had a strong liquidity with cash and cash equivalents amounting to €429 million and net interest-bearing liabilities totaling €345 million. Valmet’s net debt to EBITDA ratio was 0.49 and gearing 15 per cent.

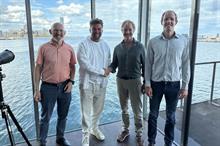

“Valmet benefits from the growing demand for bio-based products globally. With this acquisition, Valmet takes again a new step forward and strengthens both its process technologies and services segments. The combination of Valmet’s current tissue making technologies, services and automation offering and the acquired tissue converting offering and competences is a good strategic fit complementing each other and forms a strong basis to create new business opportunities and serve our customers even better. We are happy and proud to warmly welcome all the new colleagues from Körber’s Business Area Tissue to become part of Valmet,” Pasi Laine, president and CEO of Valmet, said.

“Today our Business Area Tissue is a global market player. Now, joining Valmet, this is an excellent opportunity to form a unique tissue player and set the course for the future. Our Business Area Tissue will be able to further expand its potential, offering and reach with Valmet as its committed new owner,” says Stephan Seifert, CEO, Körber Group.

“Valmet has profound market expertise, a strong customer focus, and extensive experience in integrating additional competencies. We are very pleased that in Valmet we have found an ideal future partner for our employees, customers, and suppliers to leverage the full potential of our tissue business,” says Oswaldo Cruz, CEO, Körber’s Business Area Tissue.

Fibre2Fashion News Desk (RR)