Gross margin for the first half of the year was 16.1% compared to 15.5% in the same prior year period. Gross profit increased $5.6 million or 17.3% compared to the same prior year period. Volume contributed $2.8 million, better pricing and changes in product mix contributed $2.9 million, and lower conversion and manufacturing costs contributed $0.6 million. Gross profit was partially offset by $0.7 million by foreign currency.

SG&A expense for the first half of the year was $22.7 million compared to $18.7 million in the first half of 2011, an increase of $4.0 million. This increase was primarily related to the global expansion of our sales force ($1.2 million), public company costs ($1.2 million), increased depreciation and other costs related to our global ERP system ($1.8 million) and professional fees associated with a potential acquisition ($0.6 million), partially offset by lower restructuring expense and management fees. Gross margin for the first half of the year was 16.1% compared to 15.5% in the same prior year period. Gross profit increased $5.6 million or 17.3% compared to the same prior year period. Volume #

Adjusted net income for the first half of the year was $4.7 million, adjusted for non-recurring costs associated with our IPO, loss on extinguishment of debt, professional fees associated with a potential acquisition and management fees, or $0.28 per fully diluted share, compared to $1.1 million in the same prior year period.

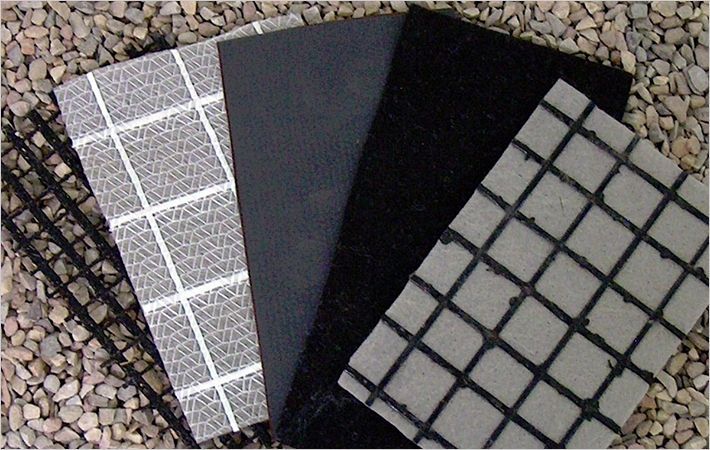

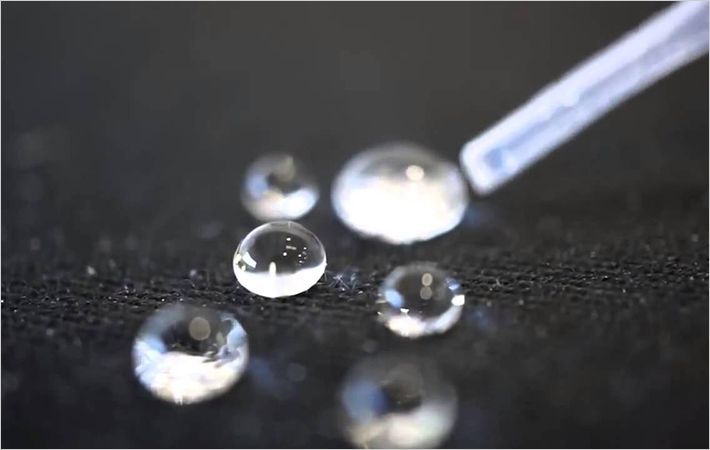

GSE is a global manufacturer and marketer of geosynthetic lining solutions, products and services used in the containment and management of solids, liquids, and gases for organizations engaged in waste management, mining, water, wastewater, and aquaculture.

GSE Holding Inc