Fiberweb plc, a leading international specialty industrial and construction materials business, announces its interim results for the six months ended 30 June 2012.

Highlights

•Like-for-like volumes up 1.8% with like-for-like revenues up 8% to £161.2 million (H1 2011: £151.5 million).

•Group underlying operating profit up 8% to £8.0 million (H1 2011: £7.4 million), more than double H2 2011; underlying operating margin of 5.0% up 140 basis points compared with FY 2011.

•Profit before tax of £2.9 million (H1 2011: loss of £7.4 million).

•Underlying earnings per share trebled to 2.8p (H1 2011: 0.9p). Interim dividend maintained at 1.0p per share.

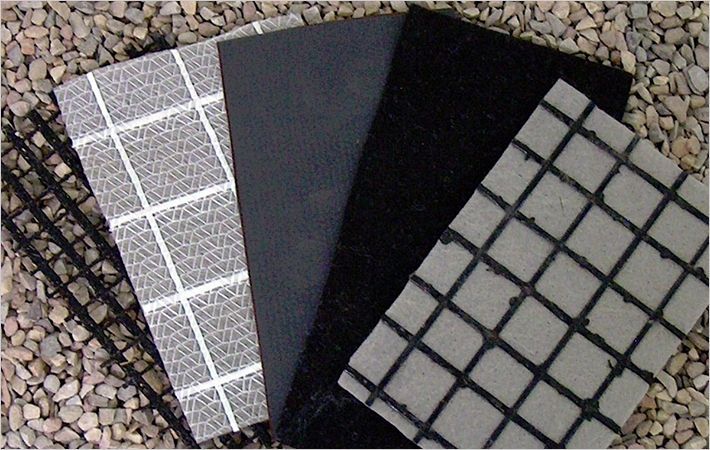

•Good Geosynthetics performance on back of US housing recovery with underlying operating margins at 5.2% (H1 2011: loss 11.7%); weaker in Technical Fabrics from poor performance in European construction with underlying operating margins of 7.6% (H1 2011: 11.6%).

•Working capital as a percentage of annualised sales reduced to 14.1% (31 December 2011: 15.4%), releasing £2.5 million of cash.

•Proforma ROCE up to 9.0% based on annualised H1 2012 results; ROCE was 6.4% based on last twelve months' results.

•Net cash of £7.9 million after first-half weighted capital expenditure of £10.1 million and disposal-related and restructuring cash spend of £11.3 million (31 December 2011: net cash of £22.0 million).

Daniel Dayan, Chief Executive, commented:

“These interim results demonstrate the underlying strength of Fiberweb's diversified specialty industrial and construction materials portfolio and the initial benefit of greater focus and balance sheet strength. In generally tough markets, we grew volumes, sales and margins, while reducing working capital. The restructuring of central costs following last year's Hygiene disposal was completed, a major new production line in the UK was successfully commissioned and progress was made in several important product development projects, preparing the ground for further top-line growth and cost reduction. Consequently, we remain confident of meeting Board expectations, although we are mindful of current economic uncertainties.”

Fiberweb