2013 SECOND QUARTER FINANCIAL OVERVIEW

-Sales volume was 77.5 kilotons, up 0.3% compared to 77.2 kilotons in the second quarter 2012

-Sales revenue was $334.5 million, down $41.2 million compared to $375.8 million in the second quarter 2012. Decreases in global product sales prices associated with lower average raw material costs accounts for $37.2 million of the revenue decline and changes in foreign currency exchange rates accounted for $2.9 million of the revenue decline.

-Adjusted EBITDA was $29.7 million, compared to $45.0 million in the second quarter 2012. The period--over-period decline of $15.4 million reflects a $16.3 million negative impact associated with the spread between FIFO and estimated current replacement cost ("ECRC"). Net of the impact of this spread, Adjusted EBITDA at ECRC was $32.0 million, compared to $31.0 million in the second quarter 2012.

-Net income attributable to Kraton was $3.8 million or $0.12 per diluted share, compared to $12.4 million or $0.38 per diluted share in the second quarter 2012

-Adjusted earnings per diluted share were $0.15, compared to $0.46 in the second quarter 2012. Additionally, the spread between the FIFO basis of accounting and the ECRC basis decreased earnings per diluted share by $0.08 in the second quarter 2013 and increased earnings per diluted share by $0.32 in the second quarter 2012. Furthermore, the impact of our ability to use net operating loss carryforwards to offset taxes amounted to $0.09 per diluted share during the second quarter 2013 and $0.01 per diluted share during the second quarter 2012.

-Cash provided by operating activities was $16.3 million in the second quarter 2013, compared to $12.7 million in the second quarter 2012.

"Our second quarter 2013 sales volume of 77.5 kilotons was essentially unchanged in comparison to the second quarter 2012, and was below our expectations, principally due to a slower than anticipated start to the paving and roofing season in May following weather related delays in April.

“Although we continue to see pockets of softness, sales momentum in general accelerated towards the end of the quarter. Moreover, our Advanced Materials end use saw a 3% year-on-year increase in sales volume, which served to offset modest sales volume decreases in our Adhesives, Sealants & Coatings and CariflexTM end use markets," said Kevin M. Fogarty, Kraton's President and Chief Executive Officer.

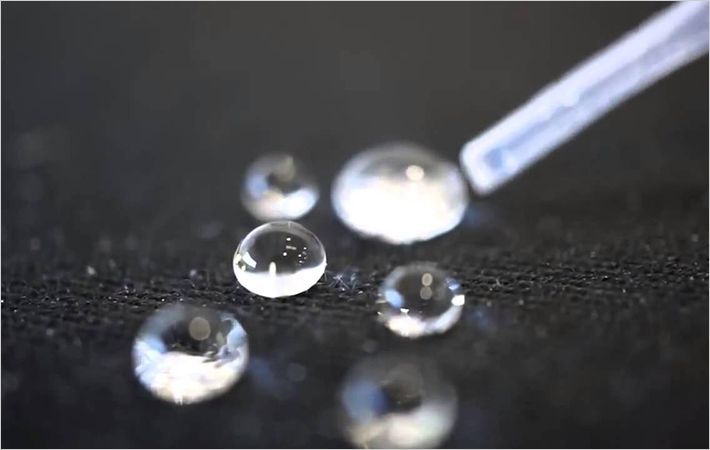

"During the second quarter we continued to focus on expanding sales of our Cariflex products and on accelerating sales of our HSBC-based innovation grades. During the quarter we achieved the second commercial application of our NEXARTM membrane technology in an Energy Recovery Ventilation application and we saw continued growth of sales in oilfield applications as well as opportunities to expand market penetration of our polymer grades for highly-modified asphalt, particularly in developing economies. For the twelve months ended June 30, 2013 our Vitality Index remained at 14%," added Fogarty.

"With respect to the raw material environment, we expect worldwide pricing for butadiene to drop sharply in August, following declines in July. Given the magnitude of the anticipated decline, we currently expect the third quarter 2013 spread between inventory valuation on a FIFO basis and estimated current replacement cost will be approximately $25 million."

Kraton Performance Polymers