The adjusted EBIT margins stood at 19 per cent, alongside robust adjusted EBITDA margins of 25 per cent. The diluted earnings per share (EPS) were reported at $3.40, with an adjusted diluted EPS of $3.59, the company said in a press release.

However, the company faced challenges in its cash flow management, with an operating cash flow of $24 million and a free cash outflow of $128 million during the quarter.

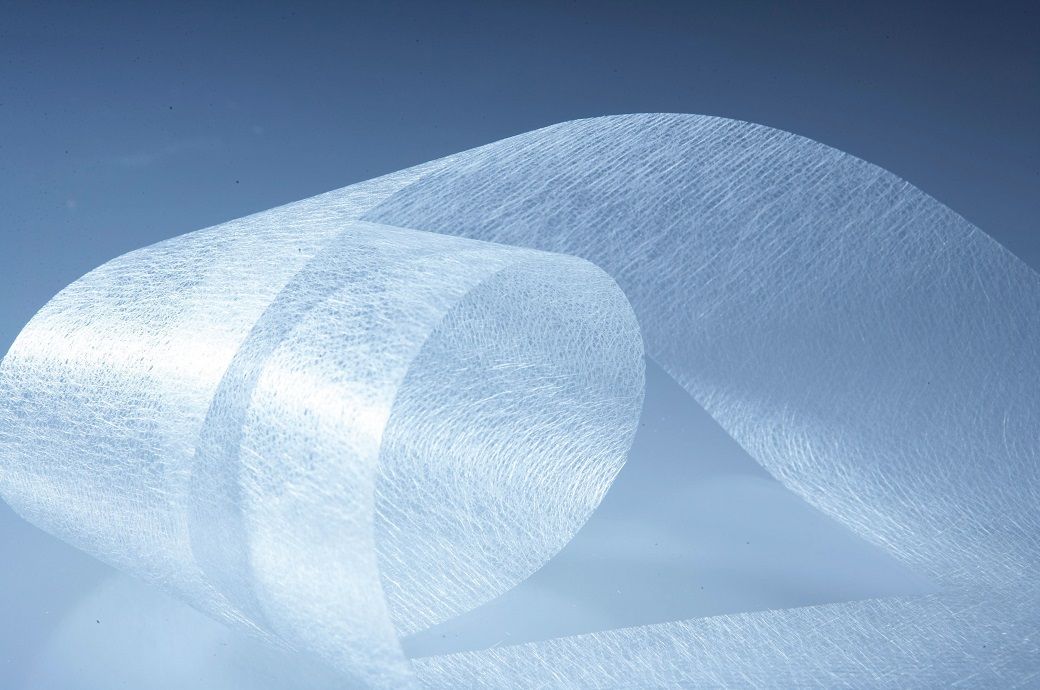

A closer look at the composites sector reveals a decline, where net sales decreased by 11 per cent to $523 million compared to the first quarter of FY23. This downturn was primarily due to reduced volumes and price declines in glass reinforcements, reflecting broader market pressures, although this was partially offset by positive pricing in nonwovens. Earnings in the composites segment fell slightly, with EBIT down $3 million to $46 million. This resulted in EBIT margins of 9 per cent and EBITDA margins of 17 per cent.

“Owens Corning started the year with first-quarter results that continue to highlight our strong and consistent enterprise performance. These results are driven by the strength of our team and the actions we have taken over the last several years to generate higher, more resilient earnings,” said chair and chief executive officer Brian Chambers. “We remain focused on helping our customers win in the market and delivering value to our shareholders in the near-term, while looking ahead to opportunities that grow our company and strengthen our leadership in building and construction materials.”

Fibre2Fashion News Desk (DP)