However, Protech Textiles are not limited to specialised applications; they are also used in everyday life through protective textiles made for homes. Additionally, durable textiles are employed by police, defence personnel, and emergency service workers for health and fire safety. The following analysis highlights the prominence of Protech Textiles and identifies the leading exporters and importers of these textiles worldwide.

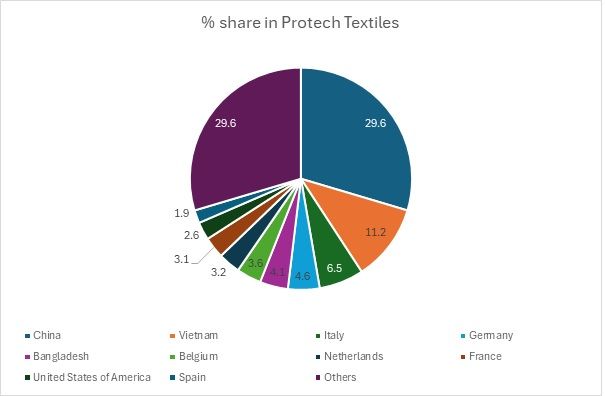

Exhibit 1: Top 10 Countries Exporting Protech Textiles (in %)

Source: TexPro, F2F Analysis

The Protech Textiles market is significantly dominated by China, which holds a substantial 29.6 per cent share, showcasing its pivotal role as a manufacturing powerhouse. Vietnam is an emerging market with 11.2 per cent, reflecting its rapid growth and increasing attractiveness for global sourcing. In Europe, Italy (6.5%) and Germany (4.6%) contribute notably, driven by advanced textile technology and design capabilities, while Belgium (3.6%) and the Netherlands (3.2%) indicate a robust European textile sector. Bangladesh, at 4.1 per cent, highlights its competitive labour costs and expanding capabilities in specialised textiles. The United States represents a niche market with a 2.6 per cent share, likely focused on high-quality or specialised products rather than mass production. The ‘Others’ category, comprising 29.6 per cent, suggests a diverse range of countries participating in the market, emphasising global distribution and production capabilities.

It is important to note that the US, which is usually the most demand-driven economy in the case of imports, has a small but significant position in the top 10 countries exporting Protech Textiles to the world. Protech Textiles depict a country’s capability to engage in research and technology-driven textile exports. The US’s surprise entry into the list depicts the US’ specialised technology, especially in military and industrial-based textiles. The US also invests in research and development for domestic use and due to their one-of-a-kind, has given the US a significant upper hand in the Protech Textiles category.

Countries importing Protech Textiles: How both Wars and Industrial Development sustain Protech Textiles?

Protech Textiles, as explained earlier is extensively used for human protection in harsh situations. Protech Textiles find great usage in case of countries that are involved in war or are preparing to upgrade their technical capabilities.

The Russia-Ukraine War and the West Asia Crisis

Analysing Russia's Protech textile imports from 2012 to 2023 reveals notable fluctuations in the share of these imports relative to total imports. The most significant year is 2020, when the share peaked, indicating a substantial increase in reliance on Protech Textiles. This spike contrasts sharply with the surrounding years, which generally see much lower shares. Another notable year is 2019, with a significant share, suggesting a gradual increase leading up to the 2020 peak. In the years following 2020, the share declined in 2021 and further down in 2023 indicating Russia’s cutting off from leading exporters from the US and EU owing to sanction on the country due to its engagement in war with Ukraine.

The year 2020 is significant because Russia started its operations for war against Ukraine in the following year 2021. China accounted for around 84 per cent of the Protech Textiles imports by Russia. Given China’s ability to invest in research and development and Russia’s not-so-friendly relations with other top countries such as the US, China’s significant portion is an indicator that Russia was preparing for a war. In addition to top suppliers like China, Vietnam and Myanmar, Russia buys from its previous Soviet Union member countries such as Belarus, Armenia and Romania. Belarus and Armenia are both part of the CSTO (Collective Security Treaty Organization) which is a counterpart to NATO. Romania despite its closeness to the US and the NATO, has been a significant contributor to Protech Textiles. Given the trade route closeness between the two Slavic countries, Russia has consistently bought from Romania, however, there has been a dip in CY 2020, before the steep rise in CY 2021.

While checking Ukraine’s imports in Protech Textiles, it was in CY 2022 that Ukraine imported a whopping $90.4 million worth of Protech Textiles. This was also the year when Ukraine was severely involved in a war with Russia. Unlike Russia, Ukraine’s top 10 supplying countries do not include many of its neighbours, with only Poland featuring in the top 10 supplier countries. Poland has been a significant supporter of Ukraine in its war efforts against Russia. All the data points reveal the fact, that both countries significantly increased their import choices when they were about to engage or were engaged in the war.

How usage of Protech Textiles has increased in the West Asian region

The West Asia region has been predominantly involved in war for the last few years. The biggest players are Israel, Iran and also their neighbouring countries. Similar to Russia and Ukraine, Israel saw an increase in the importation of Protech Textiles in 2020, owing to the COVID-19 crisis and probable preparation for the attack on the Gaza Strip in 2021 termed as the “Unity Intifada”.

One of the biggest winners that came out of importing Protech Textiles to Israel is the US. The US was able to increase its percentage share from 9.6 per cent to 23.2 per cent for Protech Textiles. The US’ continued support along with its advanced technological research and development in the sector. Iran has only restricted itself to three countries for its Protech Textiles needs—China, the UAE and Türkiye. Iran’s increased economic and political relations have favoured China’s predominance in the Protech Textiles sector.

The calendar year 2020 is rightfully significant for all countries given the year was the peak of the COVID-19 pandemic. During the COVID-19 pandemic, Protech Textiles played a critical role in addressing public health challenges and enhancing safety measures. These specialised textiles, known for their protective properties, were extensively utilised in the production of personal protective equipment (PPE) such as masks, gowns, and face shields. Their durability and ability to be treated for antimicrobial properties made them ideal for frontline workers and healthcare settings. Additionally, Protech Textiles found applications in creating barriers in public spaces and for use in various essential industries.

How Industrial Development has affected the growth of Protech Textiles

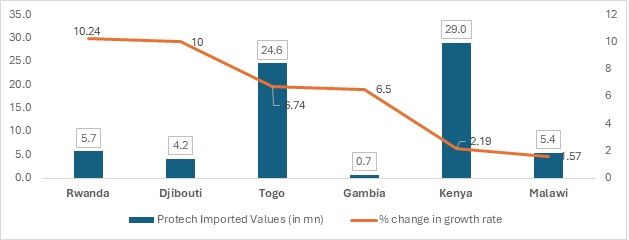

Exhibit 2: African countries with positive % change in growth in 2023 along with high Protech Textiles import in the past 5 years (in $ million)

Source: ITCTrademap, F2F Analysis

The data on Protech Textiles’ imports reveals significant growth trends across various countries from 2022 to 2023. Notably, Djibouti experienced an astonishing 202 per cent increase in import values, indicating a surge in demand, possibly driven by strategic trade initiatives or market expansion. Togo and Gambia also showcased impressive growth rates of 79 per cent and 74 per cent, respectively, suggesting a robust market response to Protech’s offerings. Rwanda, with a 9 per cent growth in import values, reflects a steady increase, while Kenya’s more modest 18 per cent growth could indicate market saturation or increasing competition. Interestingly, Malawi’s 156 per cent increase, despite its relatively smaller import value, highlights a significant opportunity for growth. These trends suggest that Protech Textiles is gaining traction in diverse markets, with varying levels of growth potential.

F2F analysis suggests that these six African countries have the ability to import more of Protech Textiles given their hugely positive growth rate. Countries such as China, Vietnam, Bangladesh and India should concentrate on increasing their Protech exports to these countries. These African countries also show a domestic need for standard technology which can be fulfilled by upcoming Protech exporter countries such as India, Cambodia and Myanmar.

Way Forward

Protech Textile exporters should look to first invest in technology and research development that will bring forward their textiles on a global scale. Protech Textiles reached their peak during the COVID-19 pandemic indicating that people become more conscious of what textiles they use not only in their workplaces and hospitals but also in their homes. Protech Textile exporters should concentrate on countries that are investing in their healthcare sector along with the industrial and manufacturing sectors.

Protech Textiles sectors can also benefit from the war crisis that is currently taking place in the West Asian and the Slavic regions. However, there is a catch for Protech Textiles exporters, it is that during wars countries tend to look internally for resources and try to build a war economy where they rely only on local production for their defence needs. The only way to counter this is by building diplomatic relations with countries that require Protech Textiles on a large scale and exporting materials that help in their war efforts.

Protech exporters can also explore Least Developed Countries (LDCs) that show significant growth rates. Industrial growth rates have almost always correlated with the growth in Protech Textiles imports. Hence, LDCs will not only prove to be a safer market to explore but an increased import to these countries would mean overall growth and development in these regions.

Fibre2Fashion News Desk (NS)